Frequently Asked Questions

Securities Arbitration

What is a pre-dispute arbitration clause?

The new account agreement(s) you signed with your broker and brokerage firm typically contain a pre-dispute arbitration clause which provides that any disputes between the parties will be resolved in arbitration as opposed to a court of law. Although there are many differences between litigating in court versus arbitration such as less discovery and motion practice, arbitration proceedings are typically cheaper and faster than going to court with most cases being resolved within nine (9) to fifteen (15) months from the date of filing.

Where are the arbitration proceedings held?

FINRA policy provides that most arbitration hearings be held at the FINRA designated location closest to the customer at the time the dispute arose. Usually this means that hearings will be held in the closest major city to your home.

What are my attorneys’ fees?

Most securities cases are handled on a contingent (percentage) fee basis. This means clients pay no attorneys’ fees unless and until funds are collected. Clients however are still expected to pay the costs associated with the pursuit of their case such as those listed below.

How much does it cost?

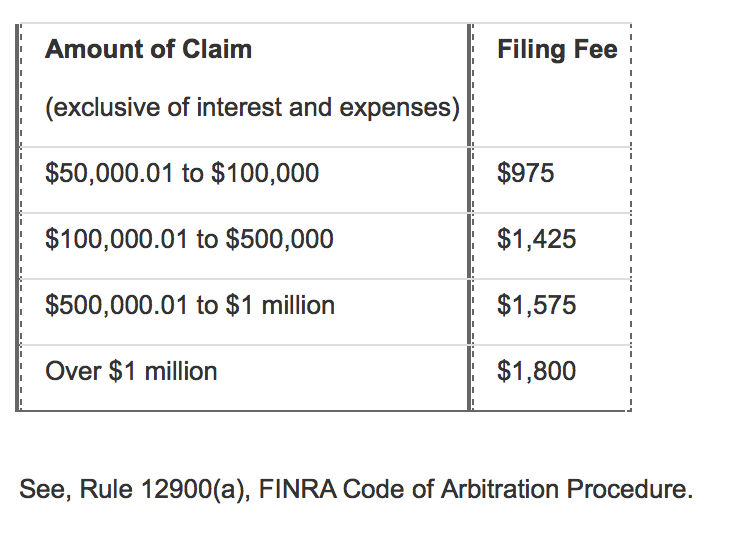

Customers seeking to pursue claims in arbitration against their financial professionals typically incur the following costs: filing fees (averaging approximately $1425), arbitration forum fees, copy costs, express mail fees, legal research fees, travel costs and if necessary expert witness fees.